Homebuyers can expect higher inventory, more choices this fall, Realtor.com finds: Tips for buying now

Owning a home may be easier this fall with increased inventory, according to Realtor.com data. Whether you're a first-time buyer or a seasoned homeowner, here's how to find the right home and type of loan for you. (iStock)

Housing inventory is at its highest point of 2021, according to data from Realtor.com, which means homebuyers will have more homes to choose from this fall and a less competitive housing market.

In addition to higher inventory, the share of sellers who made price adjustments grew for the second month in a row in September — signaling that sellers must lower their prices to compete for buyers. Keeping in line with seasonal trends, homes are lasting on the market for slightly longer at 43 days, giving buyers more time to make a decision.

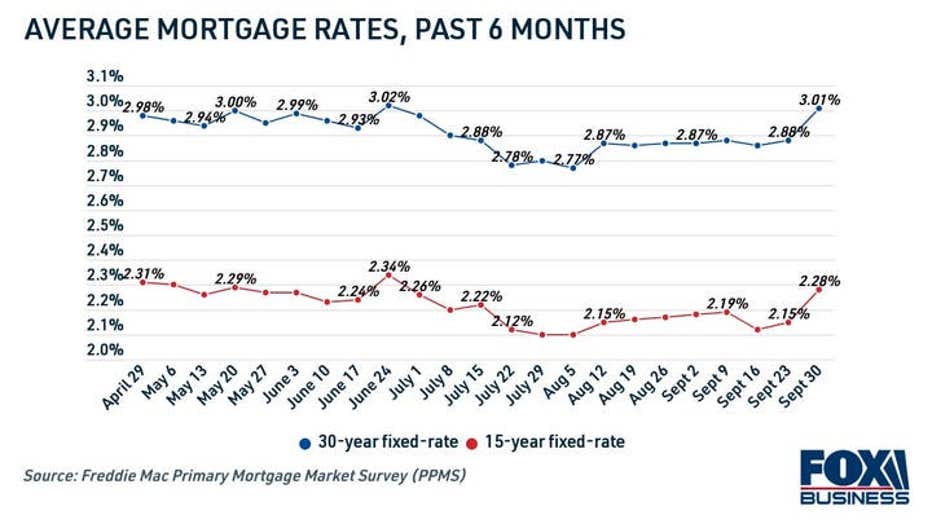

This will create a favorable environment for prospective homeowners who want to buy a home while locking in a low interest rate. Mortgage rates broke above 3% for the first time since June, according to Freddie Mac, but they're still near historic lows.

Despite this good news for buyers, inventory is still historically low due to supply issues following the COVID-19 pandemic. Compared to years past, buyers will still face a limited inventory and thus more competition. If you're planning on buying a home this fall, keep reading to learn tips for competing in a seller's market.

When you're ready to start shopping around for your next house, visit Credible to compare mortgage rates without impacting your credit score. This way, you can know you're getting the lowest rate possible for your situation.

WHAT ARE USDA LOANS AND AM I ELIGIBLE FOR ONE?

How to buy a house in a hot market

Higher inventory for the month of September is good news for buyers, but that doesn't mean buying a house will be a walk in the park. Prospective homeowners should be prepared for healthy competition in the housing market this fall. Here are some things you can do to prepare for the home buying process.

AVERAGE MORTGAGE CLOSING COSTS AND FEES TOP $6,000, STUDY FINDS: HERE'S HOW TO PAY

Be flexible with your schedule and home buying timeline

Based on seasonal trends, fall is not a particularly popular time to buy a house. This can lead to less competition, but you'll still need to be ready to tour homes as soon as they're listed on the market if you're serious about buying.

Make arrangements with your work schedule so you can be among the first buyers to tour new listings and keep in close contact with your real estate agent to stay in the loop about new housing inventory.

Being flexible can pay off even more if you don't have a firm closing date. Giving the seller more time to move out and figure out their housing arrangements may help set your offer apart from the others in a bidding war.

WHAT ARE THE NEW FHA LOAN LIMITS FOR 2021?

Come prepared with a preapproval letter

Having your mortgage financing in order shows that you're a serious buyer. Plus, with mortgage rates holding steady near historic lows, you can act now to lock in a good mortgage rate for your home purchase.

Thankfully, it's easy to get preapproved for a home loan with an abundance of online tools at your disposal. You can compare mortgage preapproval offers from multiple mortgage lenders at once on Credible's marketplace. Doing so will not impact your credit, and shopping around can help guarantee you get a competitive mortgage rate.

FIRST-TIME HOMEBUYERS PROGRAMS: WHAT NEW BUYERS NEED TO KNOW

Look at homes below your budget in case you need to offer above the list price

A competitive housing market may lead to buyers offering well above the asking price to have their bids accepted. When looking at homes in your price range, focusing on the lower end can free up some cash if you need to offer more than you initially expected in upfront costs.

Keep in mind, though, that just because you offer above the asking price doesn't mean the home is worth that much. If you submit a higher offer and the home doesn't appraise for the full amount, you might have trouble securing a mortgage — and you might be asked to cover the difference in cash.

WHAT IS THE MINIMUM CREDIT SCORE NEEDED FOR A CONVENTIONAL LOAN?

Use a mortgage calculator to see how much home you can afford

The median home price in September held steady at a record high of $380,000, according to Realtor.com data. While this may seem like an unfathomably large sum, the monthly payments may be more manageable than you think —especially considering the soaring cost of rent.

Assuming a 20% down payment and an interest rate of 3.36%, the monthly payment on a 30-year mortgage would be less than $1,400. Of course, if you don't have tens of thousands of dollars saved up for a down payment, you may be stuck putting a smaller amount down and paying for private mortgage insurance (PMI).

Use Credible's mortgage calculator to estimate your monthly mortgage payment based on the home prices you're considering. This can help you better understand which homes are out of your budget and which ones you can afford.

VETERANS BORROWING VA LOANS AT A RECORD PACE, STUDY SHOWS

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.