Today’s 20-year mortgage refinance rates hold at 11-day low | Oct. 20, 2021

Our goal here at Credible Operations, Inc., NMLS Number 1681276, referred to as "Credible" below, is to give you the tools and confidence you need to improve your finances. Although we do promote products from our partner lenders, all opinions are our own.

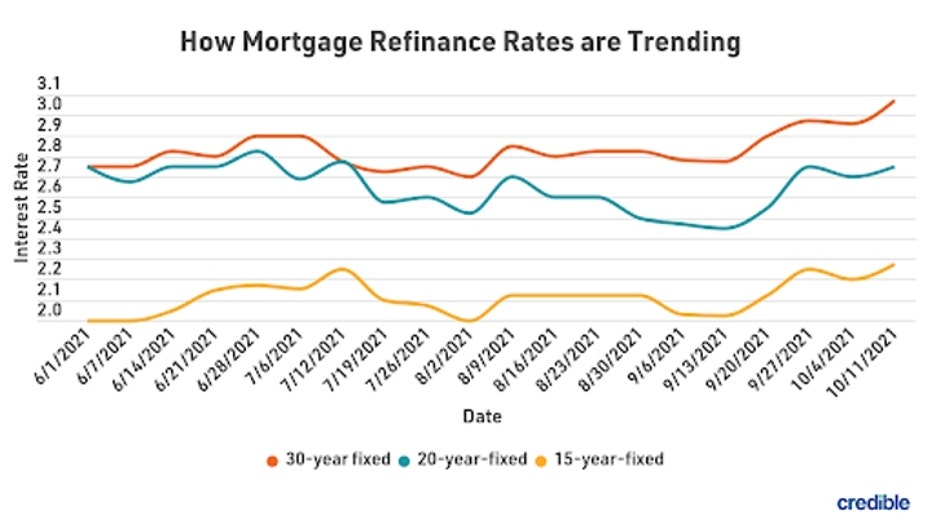

Check out the mortgage refinancing rates for Oct. 20, 2021, which are mostly unchanged from yesterday. (iStock)

Based on data compiled by Credible, current mortgage refinance rates remained largely unchanged compared to yesterday’s, except for 30-year rates, which rose.

- 30-year fixed-rate refinance: 3.125%, up from 2.990%, +0.135

- 20-year fixed-rate refinance: 2.750%, unchanged

- 15-year fixed-rate refinance: 2.375%, unchanged

- 10-year fixed-rate refinance: 2.375%, unchanged

Rates last updated on Oct. 20, 2021. These rates are based on the assumptions shown here. Actual rates may vary.

Even though experts predict mortgage refinance rates are likely to continue rising, homeowners still have time to score a deal on a refinance. Rates for 20-year terms have held at 2.750% for 11 straight days. Homeowners who choose this term can reap interest savings while keeping their monthly payments manageable. Meanwhile, 30-year rates jumped above 3% for the first time this week and 10-year and 15-year rates have held at 2.375% for the third straight day.

If you’re thinking of refinancing your home mortgage, consider using Credible. Whether you're interested in saving money on your monthly mortgage payments or considering a cash-out refinance, Credible's free online tool will let you compare rates from multiple mortgage lenders. You can see prequalified rates in as little as three minutes.

Current 30-year fixed refinance rates

The current rate for a 30-year fixed-rate refinance is 3.125%. This is up from yesterday. Refinancing a 30-year mortgage into a new 30-year mortgage could lower your interest rate, but may not have much effect on your total interest costs or monthly payment. Refinancing a shorter term mortgage into a 30-year refinance could result in a lower monthly payment but higher total interest costs.

Current 20-year fixed refinance rates

The current rate for a 20-year fixed-rate refinance is 2.750%. This is the same as yesterday. By refinancing a 30-year loan into a 20-year refinance, you could secure a lower interest rate and reduced total interest costs over the life of your mortgage. But you may get a higher monthly payment.

Current 15-year fixed refinance rates

The current rate for a 15-year fixed-rate refinance is 2.375%. This is the same as yesterday. A 15-year refinance could be a good choice for homeowners looking to strike a balance between lowering interest costs and retaining a manageable monthly payment.

Current 10-year fixed refinance rates

The current rate for a 10-year fixed-rate refinance is 2.375%. This is the same as yesterday. A 10-year refinance will help you pay off your mortgage sooner and maximize your interest savings. But you could also end up with a bigger monthly mortgage payment.

You can explore your mortgage refinance options in minutes by visiting Credible to compare rates and lenders. Check out Credible and get prequalified today.

Rates last updated on Oct. 20, 2021. These rates are based on the assumptions shown here. Actual rates may vary.

These rates are based on the assumptions shown here. Actual rates may vary.

Think it might be the right time to refinance? You can explore your mortgage refinance options in minutes by visiting Credible to compare rates and lenders. Check out Credible and get prequalified today.

Rates last updated on Oct. 20, 2021. These rates are based on the assumptions shown here. Actual rates may vary.

How much equity do I need to refinance my home?

When you apply for a refinance mortgage, lenders will consider how much equity you currently have in your home. If you don’t meet the lender’s equity requirements, you may not qualify for a refinance with that lender.

Requirements can vary from lender to lender, and depend on the type of refinance you’re doing — rate-and-term vs. cash-out refinance.

For a rate-and-term refinance, you may be able to qualify with as little as 5% home equity. But your lender will likely require you to purchase private mortgage insurance. Most lenders will prefer a loan-to-value ratio of at least 20% — meaning the amount you owe on your mortgage is no more than 80% of your home’s total value.

Generally, for a cash-out refinance, most lenders will want to see that you have a loan-to-value ratio, or LTV, of at least 20%. But some lenders may be flexible if you have good credit, a history of on-time bill payments and are willing to accept a higher interest rate.

To calculate your loan-to-value ratio, simply divide your loan balance by the current value of your home. For example, if your home’s value is $350,000 and you owe $325,000, your LTV is just under 93% — and you may have difficulty qualifying for a refinance.

How to get your lowest mortgage refinance rate

If you’re interested in refinancing your mortgage, improving your credit score and paying down any other debt could secure you a lower rate. It’s also a good idea to compare rates from different lenders if you're hoping to refinance, so you can find the best rate for your situation.

Borrowers can save $1,500 on average over the life of their loan by shopping for just one additional rate quote, and an average of $3,000 by comparing five rate quotes, according to research from Freddie Mac.

Be sure to shop around and compare rates from multiple mortgage lenders if you decide to refinance your mortgage. You can do this easily with Credible’s free online tool and see your prequalified rates in only three minutes.

How does Credible calculate refinance rates?

Changing economic conditions, central bank policy decisions, investor sentiment and other factors influence the movement of mortgage refinance rates. Credible average mortgage refinance rates are calculated based on information provided by partner lenders who pay compensation to Credible.

The rates assume a borrower has a 740 credit score and is borrowing a conventional loan for a single-family home that will be their primary residence. The rates also assume no (or very low) discount points and a down payment of 20%.

Credible mortgage refinance rates will only give you an idea of current average rates. The rate you receive can vary based on a number of factors.

Are there any cons to refinancing?

Refinancing a mortgage can be a good way to lower interest costs over the life of a loan, shorten your repayment term or secure a lower interest rate. But refinancing has some potential pitfalls, too.

It’s possible for refinancing to actually cost you more money than you’ll save if:

- You refinance into a repayment term that’s longer than your original mortgage. Longer repayment terms usually mean lower monthly payments — but higher interest rates and greater interest costs over the life of a loan. To reap the most savings from a refinance, try refinancing into a shorter term than you have for your current mortgage.

- You sell your home before you reach the break-even point on your new loan. Like your original mortgage, your refinance will come with closing costs. And it will take some time before your savings add up to as much as your closing costs.

That said, the con you need to consider first is closing costs. You’ll need to fund these from your own pocket or roll them into the loan (which raises its lifetime costs). Closing costs typically run 3% to 5% — or more — of the amount you’re borrowing. So if you want to refinance your $200,000 loan to get a lower interest rate, you’ll pay an estimated $6,000 to $10,000 in closing costs.

Credible also has a partnership with a home insurance broker. You can compare free home insurance quotes through Credible's partner here. It's fast, easy and the whole process can be completed entirely online.

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.

As a Credible authority on mortgages and personal finance, Chris Jennings has covered topics that include mortgage loans, mortgage refinancing, and more. He’s been an editor and editorial assistant in the online personal finance space for four years. His work has been featured by MSN, AOL, Yahoo Finance, and more.