Advance Child Tax Credit filing confusion cleared up

What you need to know about the Advanced Child Tax Credit on this year's return

When it comes to filing your tax return, making sure you've got the Advanced Child Tax Credit right may seem confusing. FOX 5 I-Team's Dana Fowle talks to a tax filing expert for a bit of guidance.

ATLANTA - The processing of tax returns hasn’t been normal for a few years now. And it’s not getting back on track this filing year either. There are changes, hiccups, and so many problems.

We have been turning to Bill Nemeth for years to help sort out tax season questions. As a decades-long tax expert with a Master's degree from MIT, he even says this tax season will be a doozy.

"This is not the IRS’s finest day, is the net of it. The IRS did not put a lot of thought into what they were doing, and the result is everyone is confused."

Let’s help you tackle one area of confusion. It’s how to manage the Advance Child Tax Credit on this year’s return. A quick reminder that you may have received some of that credit in advance, starting in July, as a once-a-month check through December.

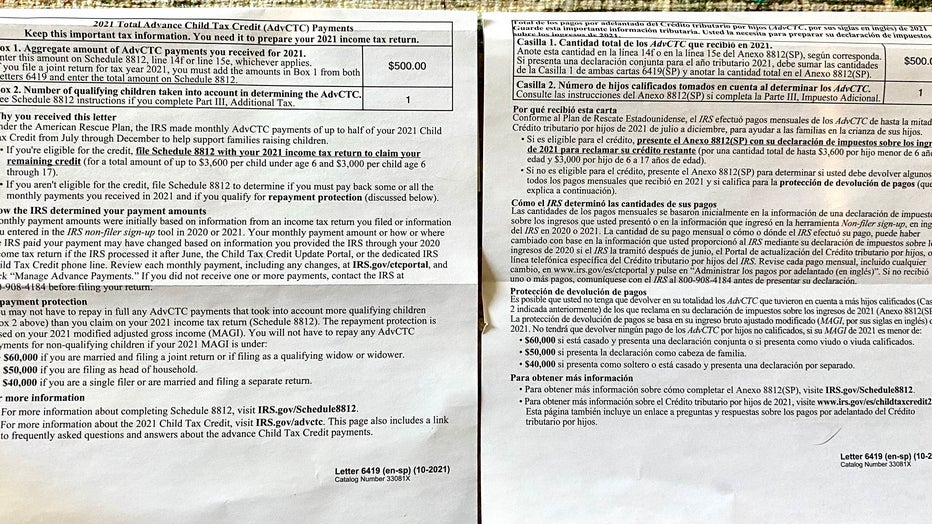

You most likely received from the IRS Letter 6419. If you are married and filed jointly, this is an example of what you may have received. Two forms, one for each filer, generally for equal amounts. Those figures added together are what you received over the last six months.

IRS Letter 6419 will give you your Advance Child Tax Credit totals.

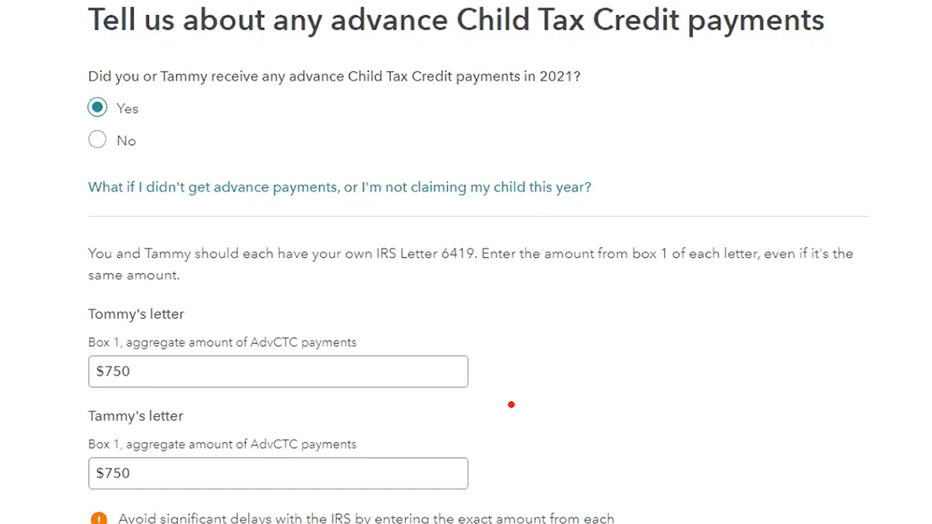

When you file the 2021 return, it may look like this. Mr. Nemeth offered a mockup of a TurboTax page for Tommy and Tammy Taxpayer. In this example, they both got letters for $750 a piece. You fill in the total from Tommy’s letter then another $750 for Tammy below it. The numbers go in separately. Do not make the mistake of adding them together and putting them in a single line.

If you received two Letters 6419, your totals go on separate lines.

Those numbers may not be equal for a variety of reasons, namely one of you decided not to receive the advanced payment. Whatever your numbers, put the corresponding number with the corresponding name.

Some people are surprised to find they don’t get the full value of the child tax credit in their refund. That’s because many received part of that credit last year.

And, Mr. Nemeth said, if what you have for that advanced money and what the IRS have is different, the IRS will have to manually reconcile the difference. That could take a year.