Faltering finances could be the 1st signs of dementia

A new study merges mental health and the ability to pay your bills. Years before your doctor declares a dementia diagnosis, your credit score may be sending signals.

New research from economists shows how you manage your money may be one of the first signs of trouble. The New York Federal Reserve took a financial look over a 17-year span at how people who are eventually diagnosed with cognitive disorders manage their finances in the 10 years leading up to diagnosis.

There’s a real pattern here. Average credit scores begin to weaken. Payment delinquencies increase for both credit cards and mortgage payments.

What the Fed found is that the delinquencies build year after year until diagnosed. A year before diagnosis, they were 34.3 percent more likely to pay their credit card late. And their mortgage tardiness went up more than 17 percent. The financial signs can show up big five years before a medical diagnosis and before anyone suspects a cognitive issue.

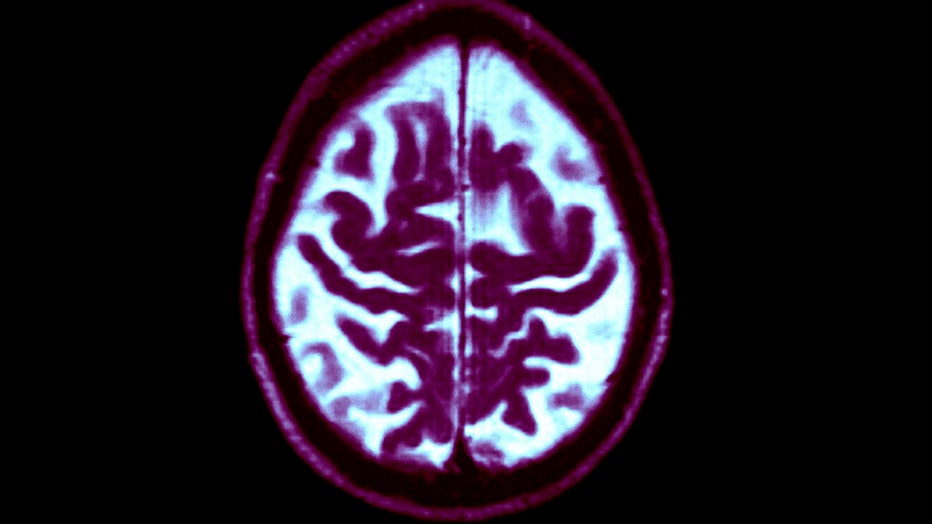

Long before brain scans show cognitive disorders, new research shows credit scores see it first. (BSIP/UIG Via Getty Images) (BSIP/UIG Via Getty Images)

This is important. Older Americans are more susceptible to financial crimes. They live on fixed incomes and can’t afford financial hits. They can potentially lose their homes from lack of payment and family may not until it’s too late to recover.