Homeowner claims her insurance policy was canceled after agent held onto her check

New homeowner says agent pocketed check, left her uninsured

A Clayton County woman claims her insurance agent held onto money that was supposed to go toward her home insurance policy—leaving her without coverage.

CLAYTON COUNTY, Ga. - A Clayton County woman claims her insurance agent held onto money that was supposed to go toward her home insurance policy—leaving her without coverage.

Now, Clayton County police are looking into the incident.

"I felt like I was going to lose my home because I didn’t have homeowners' insurance," Mary Morton told FOX 5.

For Morton, buying a new home in a new city felt like the start of an exciting new chapter. That excitement was quickly overshadowed after moving earlier this year.

"I lived in Charlotte, North Carolina, and we re-located here because I wanted an opportunity for my business," she recalled. "From April to July was a great experience, until I had to file a claim."

That claim that was filed over a water leak that contractors found in her home led her to discover she was uninsured.

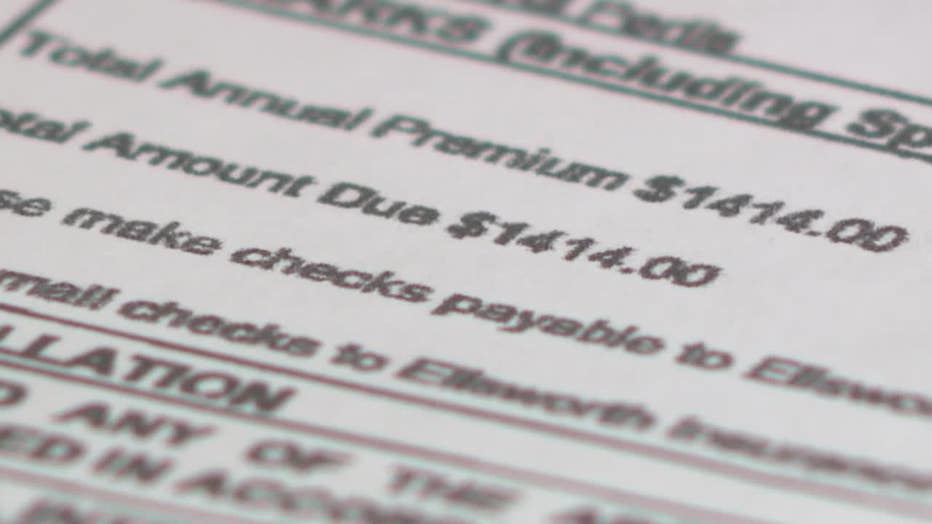

Morton says the $1,400 check that was supposed to be paid to her insurance company never made it to their account.

"When I was trying to find a claim, they couldn’t find my name in the system," she stated.

She told FOX 5 that’s because the insurance agent recommended by her mortgage company never sent the check. When she reached out about it, the agent told her it was an "error."

"She said that she forgot, and she was going to hurry up and do a policy for me," Morton explained.

She says after weeks of reaching out for updates, she stopped getting responses. That water leak eventually brought on mold, which she says she had to pay out of pocket to get remediated.

"I have a child that has breathing issues," she said. "That caused a lot of anxiety for me."

She filed a report with Clayton County police in August accusing the agent of theft by deception and identity fraud.

When she posted about it on Nextdoor, she learned she wasn’t the only homeowner in that situation.

"I filed a complaint with the insurance board for her insurance license," she stated. "There are a total of five victims that have reached out to me. Everyone was lost without insurance."

Morton says she eventually got her money back after going to the police, but the total yearly cost of her insurance tripled after getting a new policy.

She’s now urging others looking to buy to keep a closer watch on who is handling their money, and if possible, to deal with their insurance company directly.

In response to a request for comment, the agent told FOX 5 that Morton’s claim is being investigated by her Professional Liability Insurance Carrier, and that they are also countersuing Morton.

"…other alleged victims got refunds from the insurance carriers as far as a year and a half ago," the agent's statement reads in part. "We are making every effort to ensure situations like this will not occur again."