National 401(k) Day reminds us to start investing early

The financial benefits of a 401(k)

Friday is National 401(k) Day, and it's a good time to remind yourself of the benefits of contributing to the retirement savings option often and early. The FOX 5 I-Team's Dana Fowle explains why she thinks compound interest is on the of the wonders of the world.

ATLANTA - National 401(k) Day comes each Friday after Labor Day. It's meant to keep highlighting the importance of the worker and the march to eventual retirement.

As a reminder, a 401(k) is an employer-offered retirement savings plan where workers contribute part of their paycheck to the plan, and the company will often match some level of contribution to the account.

As with any savings plan, the earlier you start the better. Compounding interest is the magic there. It means contributing an initial investment and watching the interest compound year after year. It's something Albert Einstein called "The 8th Wonder of the World."

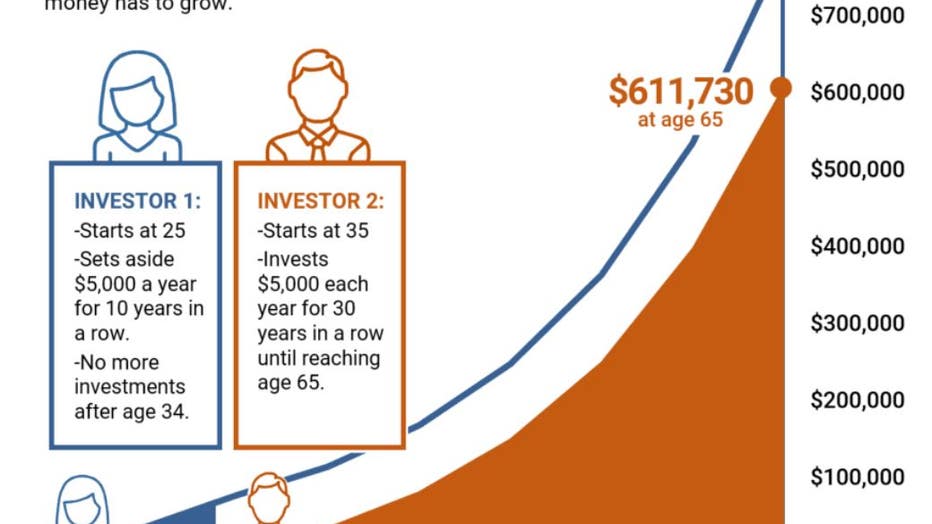

The Federal Reserve has this great visual. It compares two investors. One starts investing at age 25, starting with $5,000. But the younger person stops putting money into the account at 34. Investor number two contributes $5,000 as well, but he doesn't start until age 35. But the second investor saves for longer - through 65. Still, the shorter-term investor who starts early comes out very far ahead financially because of interest that compounds year after year. It builds on itself. For every 10 years that you put off investing, you have to contribute two times as much money over a shorter time period to get the same result.

Here are a few things to know for National 401(k) Day. In 2024, if you're under 50 years old, the limit for contributions is up to $23,000. If you are 50 or older, you can add in what are called "catch-up contributions" for a total of $30,500. A 401(k) reduces your taxable income because your contributions are pre-tax. You are taxed when you withdraw money. But, if you withdraw before 59 and a half, there is typically a 10% penalty.

If your company doesn't offer a 401-k, use an IRA account. It's very similar. This is set up by a bank or a brokerage firm. What's different is the amount you can contribute. The limit is much lower. But savings is savings.