Parents aren't teaching their children to save money

ATLANTA - We like to think we are passing down the wisdom of money management, but according to a new poll, parents have dropped the ball.

Kids for ages have gotten an allowance. That's their own spending money, hopefully, earned by doing their share around the house. Parents do it, according to new data, because 75 percent of them believe the most important reason to give a child an allowance is to teach money management skills.

But chew on this. Their kids aren't saving money. Of those parents who think it's so important only 3% of their kids actually do it. Ninety-seven percent blow their cash. That's a missed opportunity to create a savings habit.

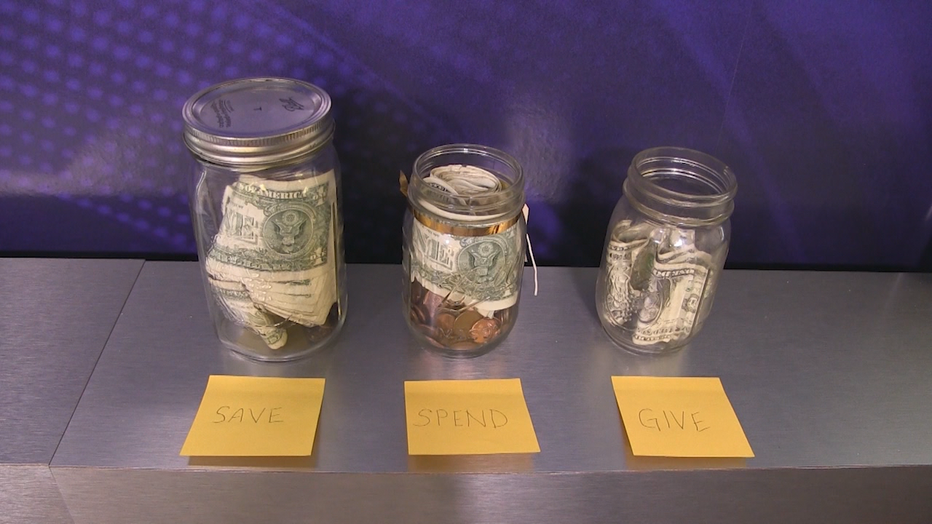

There are many ways to save, but this is how we do it. My kid gets $9 a week, but it's divided into three jars labeled "save," "spend," and "give." Give cash is for gifts. Save money is money she can't touch for many years. And the cash in the spend jar she can do as she pleases. If she's out, well, she's out until she earns more.

I'm sorry, but this is a parent problem, not the kid's. We have to show them how to do it. But, even when we do, just teaching to save isn't enough. They have to learn about money. Here are three ways to get started after you start savings.

- OFFER INCENTIVES. This is a bit like a 401(k). They save; you can match. Or, when they save, say, $400, drop more in the bucket.

- TEACH COMPOUNDING INTEREST. Once they get $1,000 saved, start a kid-friendly investment program so they can watch how their money grow.

- BE A LENDER. This will give them credit card experience. If they want a $100 item, but only have 75 bucks, loan them the $25 with interest. If they miss their payment deadline, yes, charge them a late fee.

Be an example. You can't complain later that your young adult doesn't know the value of money if you didn't show them the way.