Got student loan debt? Here’s how to get up to $2500 tax deduction

Millions of Americans have been strapped with making student loan payments, especially when the interest on federal loans began accruing again on Sept. 1. But there may be some good news this upcoming tax season.

According to the IRS, you may be able to deduct a portion of student loan interest from your taxable income — up to $2,500 — thanks to the student loan interest tax deduction.

The deduction is for any interest paid on student loans that you took out for yourself, your spouse or your dependent. The benefit applies to all loans (not just federal student loans) used to pay for higher education expenses.

Find out if you qualify for this deduction and learn how to claim it below.

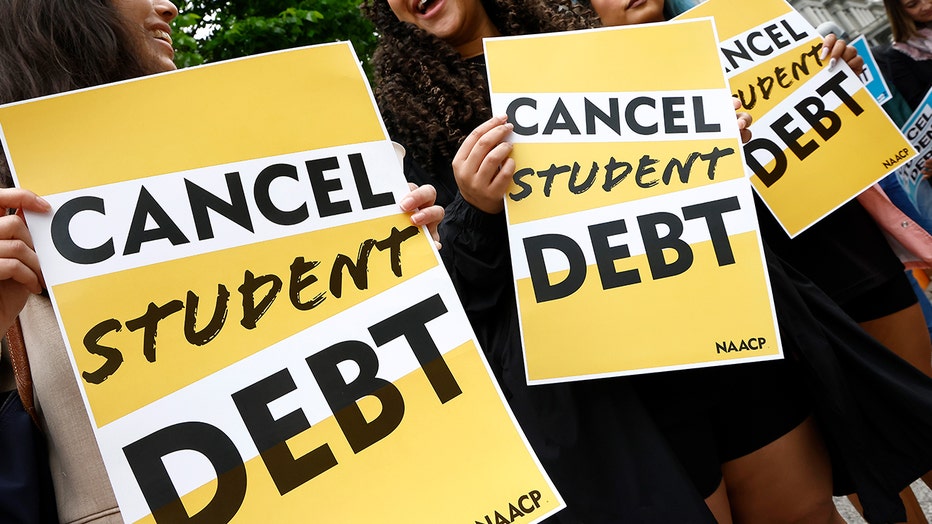

Student loan borrowers gather near The White House to tell President Biden to cancel student debt on May 12, 2020 in Washington, DC. (Credit: Paul Morigi/Getty Images for We, The 45 Million)

Can I claim student loan tax deduction?

You are eligible to receive the deduction if:

- You paid interest on a qualified student loan in tax year 2023

- You're legally obligated to pay interest on a qualified student loan

- Your filing status isn't married filing separately

- Your modified adjusted gross income is less than 90,000.

- Neither you nor your spouse, if filing jointly, were claimed as dependents on someone else's return.

For 2023, the amount of your student loan interest deduction is gradually reduced (phased out) if your modified adjusted gross income (MAGI) is between $75,000 and $90,000 ($155,000 and $185,000 if you file a joint return). You can’t claim the deduction if your MAGI is $90,000 or more ($185,000 or more if you file a joint return).

What is deductible

Deductible expenses can include interest on federal and private loans, loan origination fees, capitalized interest and interest on refinanced and consolidated student loans.

Deductions are not allowed for employer-paid interest under educational assistance programs or amounts paid from tax-free qualified tuition plans like 529 plans.

How to claim student loan interest tax deduction

You claim this deduction on your taxes as an adjustment to income, so you don't need to itemize your deductions.

You can learn more about claiming this benefit here.

Other tax credits for higher education expenses

There are also other tax credits that may be available to help offset educational expenses (tuition, fees, books, supplies and equipment).

- The American Opportunity Credit allows a person to claim up to $2,500 per student per year for the first four years of school as the student works toward a degree or similar credential.

- The Lifetime Learning Credit also allows students to claim up to $2,000 per student per year for any college or career school tuition and fees, as well as for books, supplies, and equipment that were required for the course and had to be purchased from the school.

- Coverdell Education Savings Account allows up to $2,000 a year to be put aside for a student’s education expenses (elementary, secondary, or college or career school).

Millions of student loan borrowers still aren't making payments

A recent report found that millions of Americans with student loan debt are still not paying their bills after a three-year payment hiatus ended last fall.

Federal student loan payments restarted at the beginning of October after President Biden declined to extend the pandemic-era pause that first began in March 2020 under his predecessor, former President Donald Trump.

However, 40% of the 22 million borrowers who had bills due failed to make a payment as of mid-November, according to a new report published by the Department of Education. That means about 9 million Americans who have payments due are not making them.

The figure did not include borrowers who are still in school or who recently left and do not yet owe payments, or whose payment deadlines were extended due to loan servicing errors.

This story was reported from Los Angeles. FOX Business contributed.