Will the election impact your 401(k)? Here’s what to know

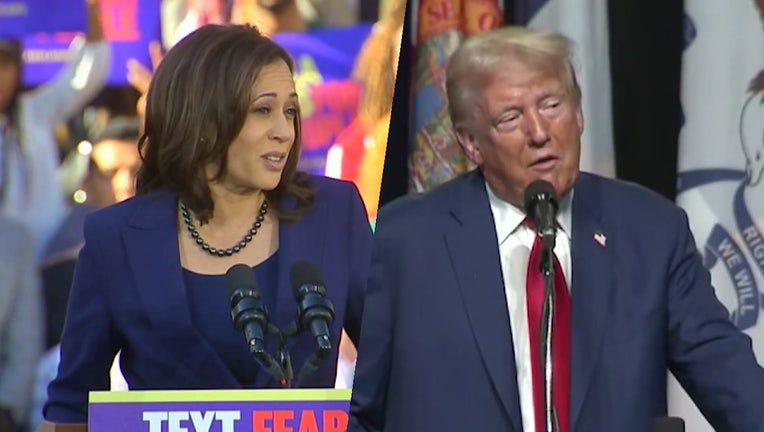

Vice President Kamala Harris and former President Donald Trump are pictured in file images.

Election years, and the prospect of change, can raise anxiety about the future – including retirement savings.

In fact, a recent survey by Voya Financial found that 35% of working Americans say they’re delaying decisions about saving for retirement until after the 2024 presidential and congressional elections.

The same survey found that 42% believe that the pending elections will have a severe or major impact on their ability to save for retirement, Voya said, which serves over 6 million individual retirement plans.

However, both short- and long-term election effects tend to be negligible, according to Voya and other financial experts.

Here’s what to know:

401(k) and elections

If your 401(k) is like many retirement savers’, with most invested in funds that track the S&P 500 or other broad indexes, all the noise may not make much of a difference.

Stocks do tend to get shakier in the months leading up to Election Day. Even the bond market sees an average 15% rise in volatility from mid-September of an election year through Election Day, according to a review by Monica Guerra, a strategist at Morgan Stanley.

That may partly be because financial markets hate uncertainty. In the runup to the election, uncertainty is high about what kinds of policies will win out.

But after the results come in, regardless of which party wins the White House, the uncertainty dissipates, and markets get back to work. The volatility tends to steady itself, Guerra’s review shows.

More than which political party controls the White House, what’s mattered for stocks over the long term is where the U.S. economy is in its cycle as it moved from recession to expansion and back again through the decades, according to Guerra

"Over the long term, market performance is more closely correlated with the business cycle than political party control," Guerra wrote in a recent report.

Where the economy currently is in its cycle is up for debate. It's been growing since the 2020 recession caused by the COVID-19 pandemic. Some pessimistic investors think the expansion is near its end, with all the cumulative slowing effects of the Federal Reserve's hikes to interest rates in prior years still to be felt. Other, more optimistic investors believe the expansion may still have legs now that the Fed is cutting rates to help the economy.

Politics may have some sway underneath the surface of stock indexes and influence which industries and sectors are doing the best. Tech and financial stocks have historically done better than the rest of the market one year after a Democratic president took office. For a Republican, meanwhile, raw-material producers were among the relative winners, according to Morgan Stanley.

Plus, control of Congress could be just as important as who wins the White House. A gridlocked Washington with split control will likely see less sweeping changes in fiscal or tax policy, no matter who the president is.

What retirement savers should do

For those planning for retirement, Voya Financial says it’s important to not react to election news. Rather, maintain your retirement savings and investment strategy and "avoid rash decisions."

It recommends increasing your overall financial literacy and researching how to best navigate market volatility with online resources.

You can also ask an employer about workplace benefits and accounts that leverage tax advantages to accelerate retirement and other savings – such as health savings accounts, and flexible spending accounts.

"These benefits may help your overall financial wellness and can help alleviate election-related anxiety," Voya said.

Additionally, Voya recommends learning about the importance of portfolio diversification during economic or political volatile periods – which can help align your retirement savings goals and risk tolerances.

Lastly, Voya notes that your employer may already offer such financial advisory services to help with retirement savings goals – just ask.