Supply and demand: Why you shouldn't expect a housing price crash

Worries over possible housing crash

FOX 5 real estate expert John Adams says concerns over a possible housing crash like 2008 are misguided based on the data he's been looking at.

Recently, we’ve all heard an increasing number of warnings from self-styled market experts predicting a crash in housing prices in the next year accompanied by a depression from which mankind may never recover.

FOX 5 real estate expert John Adams says, "Baloney!"

Adams shared his analysis of the current state of the residential housing market to show why a crash similar to 2008 is unlikely.

Housing Supply Sources

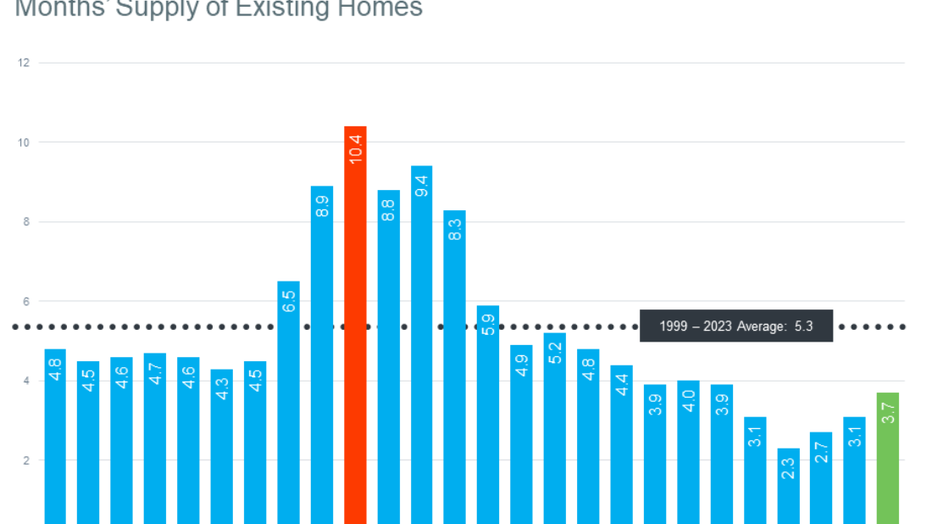

1. Existing Homes:

Currently, homeowners are not selling their properties at a rate that would lead to an oversupply. This is possibly due to various factors such as favorable mortgage rates that were locked in during the pandemic, leading homeowners to hold onto their properties.

In the years leading up to 2008, there was a significant number of homeowners selling their properties, contributing to an oversupply. This was partly due to speculative buying and the subsequent inability to service mortgage debts.

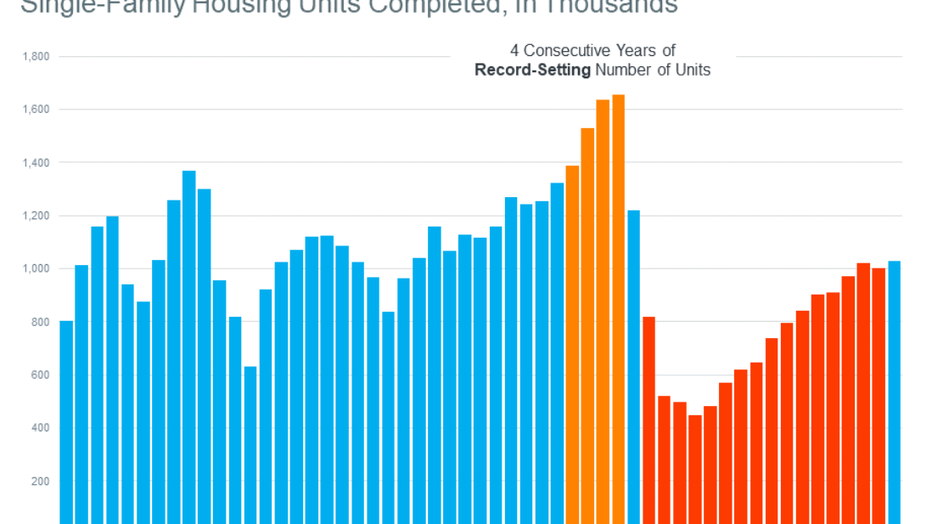

2. New Home Construction:

New home construction has not kept pace with demand. Governmental regulations, labor shortages, and high material costs have constrained the rate of new builds.

Before the 2008 crash, there was a housing boom where construction surged, leading to an excess of new homes on the market when demand plummeted.

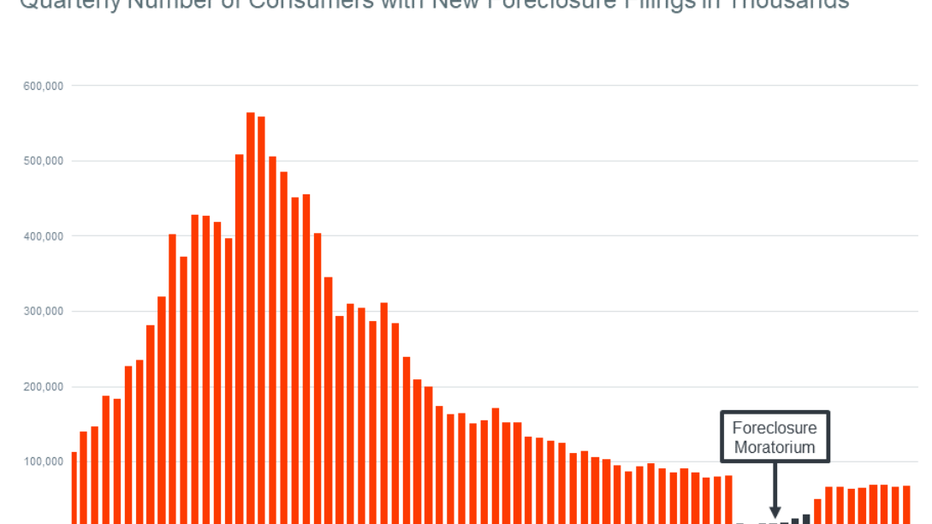

3. Distressed Properties:

The rate of foreclosures and short sales is relatively low compared to the pre-2008 period. This can be attributed to several factors including government interventions, mortgage forbearance programs, and a generally healthier economy.

On the other hand, the 2008 financial crisis was marked by a high number of distressed properties flooding the market, driven by the subprime mortgage crisis and subsequent defaults.

Current dynamics in the housing market

1. Undersupply: The fundamental issue in the current market is an undersupply of homes relative to demand. This is supporting home prices and preventing a significant downturn.

2. Inventory Growth: While there has been some growth in inventory, it is not sufficient to tip the market into oversupply. Not even close. This inventory growth is modest compared to the pent-up demand from buyers.

3. Mortgage Rates: Current mortgage rates, while higher than the pandemic lows, are still relatively favorable in historical terms, supporting buyer activity.

The conditions that led to the 2008 housing crash were characterized by an oversupply of homes, high levels of speculative buying, and a significant number of distressed properties entering the market. Today, the market dynamics are fundamentally different, with a clear undersupply of homes and fewer distressed properties.

Even with some inventory growth, the balance of supply and demand remains far from the levels that would trigger a crash.

Therefore, while fluctuations and corrections in home prices can occur, the structural factors that led to the Great Recession simply do not exist in today's housing market.

Atlanta native John Adams has been a real estate broker and investor in residential real estate for the past four decades.